What Tax Form Do I Use For Energy Credit . information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. These credits are managed by the u.s. for qualified fuel cell property, see lines 7a and 7b, later. who will issue the 2024 noec payments? You may be able to take a credit of 30% of your costs of qualified solar electric. Fill out irs form 5695, following irs instructions, and include it when filing your tax return. how to claim the federal tax credits. What is eligible rent paid and what should i enter beside box. What is a principal residence? Internal revenue service (irs) and can be claimed with your federal income taxes for the year in.

from gopaschal.com

who will issue the 2024 noec payments? how to claim the federal tax credits. Fill out irs form 5695, following irs instructions, and include it when filing your tax return. for qualified fuel cell property, see lines 7a and 7b, later. These credits are managed by the u.s. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. What is a principal residence? information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. You may be able to take a credit of 30% of your costs of qualified solar electric. Internal revenue service (irs) and can be claimed with your federal income taxes for the year in.

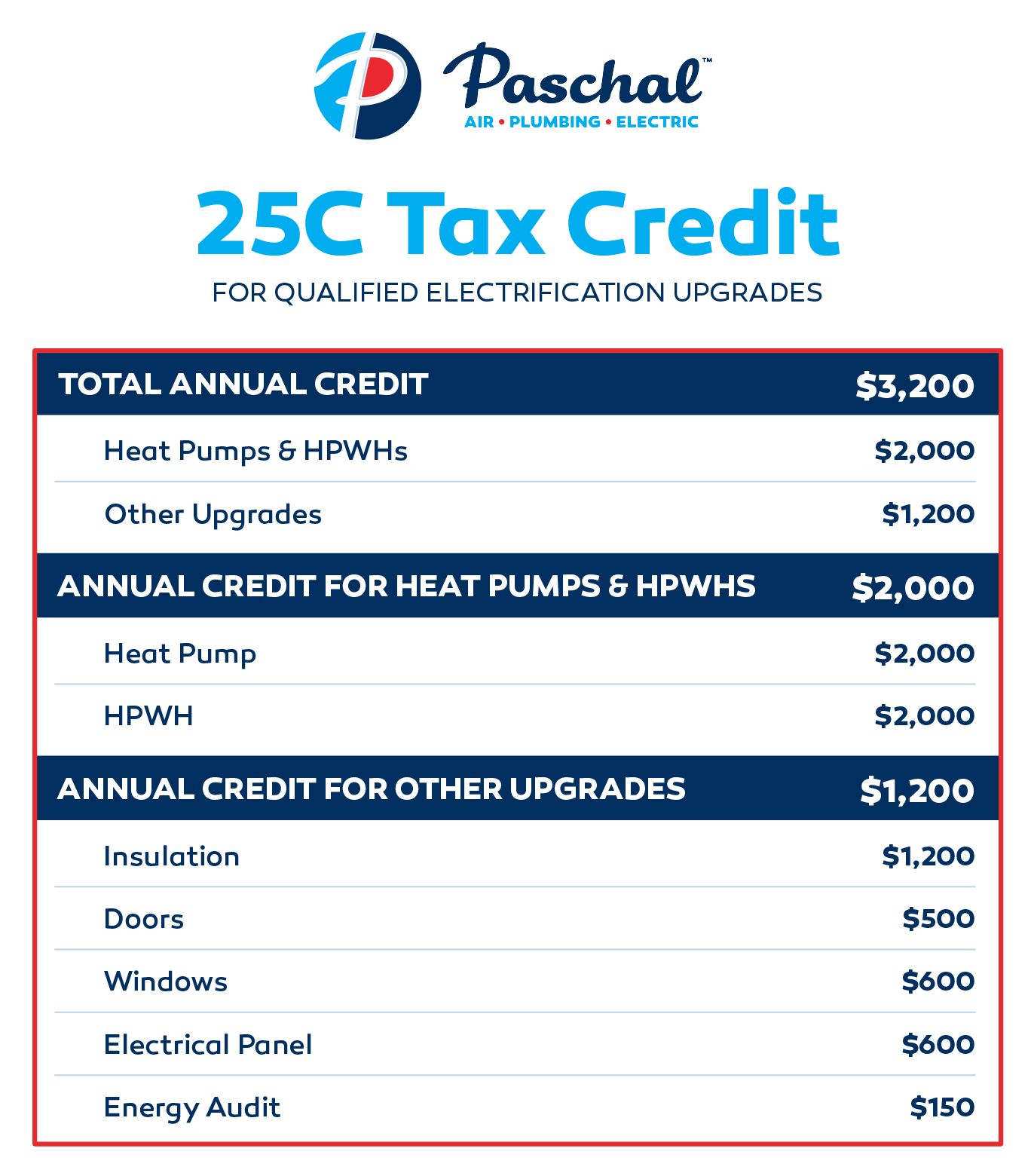

25C Residential Energy Efficiency Tax Credit Paschal Air, Plumbing

What Tax Form Do I Use For Energy Credit how to claim the federal tax credits. What is eligible rent paid and what should i enter beside box. Internal revenue service (irs) and can be claimed with your federal income taxes for the year in. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. for qualified fuel cell property, see lines 7a and 7b, later. What is a principal residence? who will issue the 2024 noec payments? information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. You may be able to take a credit of 30% of your costs of qualified solar electric. Fill out irs form 5695, following irs instructions, and include it when filing your tax return. These credits are managed by the u.s. how to claim the federal tax credits.

From medravolpi.com

Maximizing Your Tax Savings Understanding Energy Tax Credits for Home What Tax Form Do I Use For Energy Credit Internal revenue service (irs) and can be claimed with your federal income taxes for the year in. for qualified fuel cell property, see lines 7a and 7b, later. Fill out irs form 5695, following irs instructions, and include it when filing your tax return. What is a principal residence? how to claim the federal tax credits. information. What Tax Form Do I Use For Energy Credit.

From gopaschal.com

25C Residential Energy Efficiency Tax Credit Paschal Air, Plumbing What Tax Form Do I Use For Energy Credit What is eligible rent paid and what should i enter beside box. These credits are managed by the u.s. information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Fill out irs form 5695, following irs instructions, and include it when filing your tax return. You may be able to take. What Tax Form Do I Use For Energy Credit.

From www.dochub.com

Irs form 5695 instructions Fill out & sign online DocHub What Tax Form Do I Use For Energy Credit how to claim the federal tax credits. These credits are managed by the u.s. for qualified fuel cell property, see lines 7a and 7b, later. information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. you will need to file form 5695, residential energy credits when you file. What Tax Form Do I Use For Energy Credit.

From evergreenaction.com

What Are Clean Energy Tax Credits and How Do They Work? Evergreen Action What Tax Form Do I Use For Energy Credit who will issue the 2024 noec payments? What is a principal residence? you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. You may be able to take a credit of 30% of your costs of qualified solar electric. What is eligible rent paid and what. What Tax Form Do I Use For Energy Credit.

From www.solarreviews.com

How To Claim The Solar Tax Credit Using IRS Form 5695 What Tax Form Do I Use For Energy Credit What is eligible rent paid and what should i enter beside box. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. What is a principal residence? for qualified fuel cell property, see lines 7a and 7b, later. Internal revenue service (irs) and can be claimed. What Tax Form Do I Use For Energy Credit.

From a1solarstore.com

How do I claim the solar tax credit? A1 Solar Store What Tax Form Do I Use For Energy Credit who will issue the 2024 noec payments? What is a principal residence? What is eligible rent paid and what should i enter beside box. You may be able to take a credit of 30% of your costs of qualified solar electric. you will need to file form 5695, residential energy credits when you file your tax return for. What Tax Form Do I Use For Energy Credit.

From blog.constellation.com

Finding Small Business Energy Tax Credits Constellation What Tax Form Do I Use For Energy Credit Fill out irs form 5695, following irs instructions, and include it when filing your tax return. who will issue the 2024 noec payments? What is a principal residence? information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. how to claim the federal tax credits. You may be able. What Tax Form Do I Use For Energy Credit.

From www.formsbank.com

Form Wv/setc West Virginia State Tax Department Schedule Setc What Tax Form Do I Use For Energy Credit how to claim the federal tax credits. What is a principal residence? These credits are managed by the u.s. for qualified fuel cell property, see lines 7a and 7b, later. who will issue the 2024 noec payments? Internal revenue service (irs) and can be claimed with your federal income taxes for the year in. you will. What Tax Form Do I Use For Energy Credit.

From onesourcehomeservice.com

Energy Tax Credits for 2023 One Source Home Service What Tax Form Do I Use For Energy Credit information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. how to claim the federal tax credits. who will issue the 2024 noec payments? for. What Tax Form Do I Use For Energy Credit.

From www.altestore.com

How to Claim the Federal Solar Tax Credit Form 5695 Instructions What Tax Form Do I Use For Energy Credit These credits are managed by the u.s. Internal revenue service (irs) and can be claimed with your federal income taxes for the year in. What is a principal residence? who will issue the 2024 noec payments? Fill out irs form 5695, following irs instructions, and include it when filing your tax return. for qualified fuel cell property, see. What Tax Form Do I Use For Energy Credit.

From www.formsbank.com

Fillable Form 5695 Residential Energy Credits 2016 printable pdf What Tax Form Do I Use For Energy Credit What is eligible rent paid and what should i enter beside box. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. You may be able to take a credit of 30% of your costs of qualified solar electric. how to claim the federal tax credits.. What Tax Form Do I Use For Energy Credit.

From cmheating.com

2023 Energy Tax Credits CM Heating What Tax Form Do I Use For Energy Credit Internal revenue service (irs) and can be claimed with your federal income taxes for the year in. who will issue the 2024 noec payments? Fill out irs form 5695, following irs instructions, and include it when filing your tax return. how to claim the federal tax credits. What is a principal residence? What is eligible rent paid and. What Tax Form Do I Use For Energy Credit.

From www.youtube.com

IRS Form 5695 Residential Energy Tax Credits StepbyStep Guide What Tax Form Do I Use For Energy Credit who will issue the 2024 noec payments? for qualified fuel cell property, see lines 7a and 7b, later. You may be able to take a credit of 30% of your costs of qualified solar electric. What is a principal residence? information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to. What Tax Form Do I Use For Energy Credit.

From taxedright.com

Energy Tax Credits Taxed Right What Tax Form Do I Use For Energy Credit who will issue the 2024 noec payments? how to claim the federal tax credits. You may be able to take a credit of 30% of your costs of qualified solar electric. What is a principal residence? information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. These credits are. What Tax Form Do I Use For Energy Credit.

From solgenpower.com

Guide to Green Energy Tax Credits and Incentives for Homeowners What Tax Form Do I Use For Energy Credit how to claim the federal tax credits. You may be able to take a credit of 30% of your costs of qualified solar electric. These credits are managed by the u.s. information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. What is eligible rent paid and what should i. What Tax Form Do I Use For Energy Credit.

From www.solar.com

How to File the Federal Solar Tax Credit A Step by Step Guide What Tax Form Do I Use For Energy Credit You may be able to take a credit of 30% of your costs of qualified solar electric. you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. who will issue the 2024 noec payments? What is a principal residence? What is eligible rent paid and what. What Tax Form Do I Use For Energy Credit.

From www.solarreviews.com

Complete Guide to the 2024 Federal Solar Tax Credit What Tax Form Do I Use For Energy Credit you will need to file form 5695, residential energy credits when you file your tax return for year in which your residential. These credits are managed by the u.s. information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Internal revenue service (irs) and can be claimed with your federal. What Tax Form Do I Use For Energy Credit.

From www.formsbirds.com

Form 5695 Residential Energy Credits (2014) Free Download What Tax Form Do I Use For Energy Credit how to claim the federal tax credits. for qualified fuel cell property, see lines 7a and 7b, later. What is eligible rent paid and what should i enter beside box. Internal revenue service (irs) and can be claimed with your federal income taxes for the year in. you will need to file form 5695, residential energy credits. What Tax Form Do I Use For Energy Credit.